Energy Coach - July

It's here - we're in the middle of winter, and most of us are feeling the chill, as well as the pain of high energy bills. Here's our roundup of what you can do to shrink your bills while keeping your home's comfort levels high.

New ACCC study shows that the Default Offer has failed to deliver a 'safety net' for energy consumers.

Welcome to Issue #17 of Savings as a Service, our first issue for 2024. We're gearing up for another big year at Bill Hero, and we can't wait to introduce you to some incredible new innovations to the Bill Hero service that will make your energy-buying and energy-saving experience simpler and more seamless than ever before. Watch this space!

Our feature article in this issue focuses on the latest instalment in the ACCC's multi-year Inquiry into the National Electricity Market. For the first time, an official investigation has acknowledged what Bill Hero has always known: retailers charge existing customers more than what they offer to new customers, and even when you switch to a better-priced plan, they'll just increase the pricing on you again.

We literally built Bill Hero to address this problem, and finally, now an official body has noticed this same issue:

When consumers do engage with the market, it is not uncommon for their prices to increase not long after they sign up to a new plan.

This is the Loyalty Tax at work, and we're sick of it.

The only way to beat it is to remain vigilant and check your plan and the entire market of alternatives constantly, so you can switch whenever it's warranted.

But who wants to do that!? It's complicated, boring and annoying!

Bill Hero subscribers will know that this is exactly what Bill Hero does for you, automatically, on every billing cycle.

Not a subscriber yet? What are you waiting for! Never overpay for energy again! Bill Hero automatically compares every bill to help keep you always on the best priced plan.

Feature Article

The ACCC has been conducting its Inquiry into Electricity Supply in Australia since August 2018, and has published a report every six months since then.

The latest ACCC report, published in December 2023, is of particular note. This is the first official study to finally take a serious look into retail energy prices for existing customers.

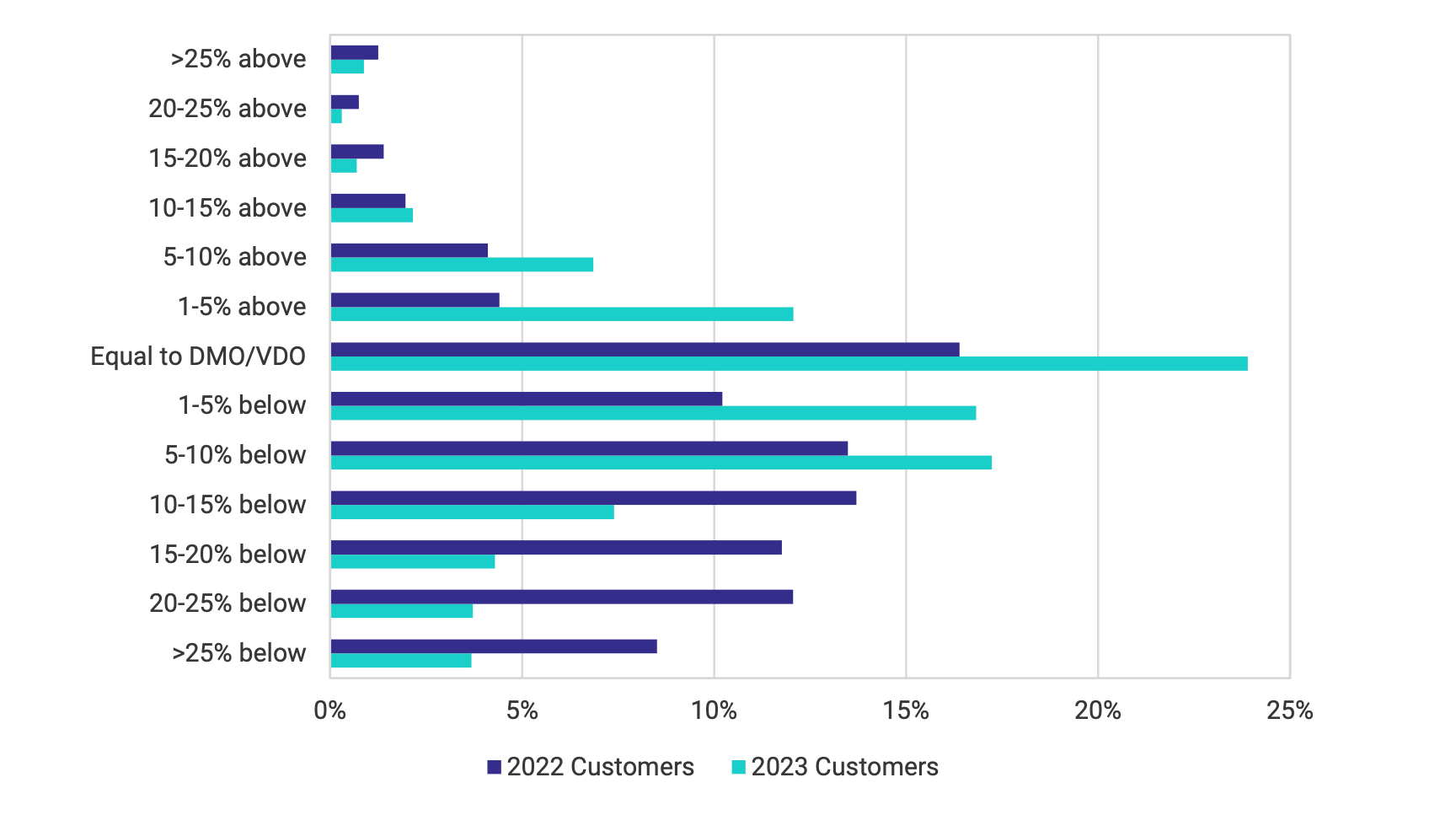

The main finding is quite astonishing. Even though 90% of households are on supposedly more competitive Market Offers (as opposed the the 'safety net' Default Offer that every retail is obliged to make available), 79% of households are paying prices equal to or greater than the median price available to them in the market, and 47% are paying prices equal to or higher than the Default Offer:

79% of Australian electricity consumers could achieve a better price if they switched.

Previous energy price investigations conducted by various regulators and official bodies have focused exclusively on the published 'acquisition prices' that retailers offer to attract new customers, and on the Default Market Offer (DMO) and Victorian Default Offer (DFO) prices that the regulators set as a reasonably priced 'safety net' for 'disengaged' customers who are not on Market Offers.

This part of the retail energy market is genuinely competitive, because acquisition prices are exposed to scrutiny, and tools like Energy Made Easy, Victoria Energy Compare, and yes, even Bill Hero, are available to help consumers identify the most competitive offers available to them.

In theory, Market Offers should be better priced than Default Offers, and at the level of acquisition pricing, this is generally true. Retailers compete on price to win new customers.

However, in practice, retailers can change prices for their customers on Market Offers at any time, with only five days' notice.

In Victoria, price surety regulation limits retailers to only a single price increase per year, but they can change Market Offer prices for existing customers as often as they like in the other states, and there is no requirement for the retailer to change the plan name.

So, Market Offer prices can change at any time, and there is no requirement for retailers to keep those Market Offer prices lower than the Default Offer price.

Unsurprisingly, retailers are generally very quick to ratchet up their prices for their existing customers. As a result, many customers on Market Offers are actually paying rates higher than the so-called 'safety net' Default Offer price.

The Default Offer was intended to set a reasonable benchmark price in the electricity market, and function as a 'soft cap' to the prices energy retailers can charge their customers.

The Default Offer is not a 'cheap' price. It sets the benchmark that discounted offers must be measured against, and it is intended as a safety net for 'disengaged' energy consumers who have not managed to enter into Market Offer with their retailer.

Despite the fact that 90% of residential customers are on the supposedly more competitive Market Offers, this study found that 47% of residential customers are paying prices equal to or higher than the Default Offer.

47% of residential customers are on plans with a calculated annual cost equal to or higher than the default offer

42% of concession customers are on plans with a calculated annual cost equal to or higher than the default offer

Most energy consumers are disengaged, retailers are systematically taking advantage of this consumer inertia, and the Default Offer has not protected consumers from overpaying for their energy.

Over time, the performance of average prices paid by energy consumers vs the default Offer 'saftey net' price has deteriorated significantly.

Several interlocking factors drive this outcome, but the inescapable conclusion from this study is that most energy consumers are disengaged, retailers are systematically taking advantage of this consumer inertia, and the Default Offer has not protected consumers from overpaying on their energy.

About 90% of residential energy plans and 80% of small business plans are Market Offers.

Historically, only those on Standing Offers, with prices capped by the Default Offer, were considered to be 'disengaged customers'.

However, Market Offer customers are just as disengaged as those on Default Offers, and most do not switch frequently or at all. These energy consumers are 'loyal' to their current retailers, and the retailers repay this loyalty by gouging them mercilessly.

The idea that only non-Market-Offer customers are 'disengaged' is incredibly naive. Nearly every energy consumer is disengaged! It's hard to imagine a purchase experience that is less appealing than retail energy.

At Bill Hero, we've always known that the actual prices charged to energy consumers are higher than the acquisition rates offered in the market. That's why we can offer our Savings Guarantee for our new subscribers, and it's why we achieve average first-switch savings of over $350.

The recent ACCC report is groundbreaking because it reveals the extent which these disengaged Market Offer energy consumers are being overcharged by their energy retailers.

Retailers rely on this to ratchet up their revenue from existing customers and they use the cash flow to fund deals and discounts to attract new customers.

Energy retailers ratchet up the prices for existing customers to fund deals and discounts to attract new customers.

Pricing experts call this 'front-book/back-book pricing', some call it Tease and Squeeze. We call it Loyalty Tax.

No matter what you call it, the reality for energy consumers is that you need to pay ongoing attention to your bills and to the market, or you'll wind up paying too much money to your retailer.

We know that's a chore. That's why we built Bill Hero to do this work for you.

Some unusual energy market activity on the very last day of 2023 provided an indication of what to expect in the future.

On New Year's Eve, 31 December 2023, rooftop solar delivered more than 100% of the state-wide energy demand in South Australia, plus two-thirds of Victoria's energy needs.

The Australian Energy Market Operator (AEMO) issued an unusual market notice for the Victorian region, seeking a 'response', ie more demand, or possible shutting down of some rooftop solar, to meet an elevated risk of 'insufficient demand' on 31/12/2023.

New operational demand records set in VIC (1,564 MW) & SA (-26 MW) on 31 December 2023, with #rooftopsolar contributing two-thirds of VIC's & all of SA's total energy needs. On the day, wholesale electricity prices averaged -$66.54 & -$73.02 ($/MWh) in SA & VIC, respectively. pic.twitter.com/0JUorY4wG4

— AEMO (@AEMO_Energy) January 2, 2024

Victoria’s lowest-ever operational demand was 1,564 MW on New Year's Eve, Sunday, December 31. This beat the previous record that was set on Sunday, November 12, 2023. SA’s demand dropped into the negatives on the same day, reaching as low as -26MW, which trumped the previous record low set back in October 2023.

As we head into 2024, these records underscore the growing significance of renewable energy in the generation fleet, and highlight the need to find new ways to balance supply and demand in our power systems.

Battlelines are being drawn among industry participants in the lead-up to the next annual revision to Default Offer prices in Victoria (Victorian Default Offer, or VDO), and for the rest of the NEM (Default Market Offer or DMO).

The Victorian Council of Social Services (VCOSS), along with with many community sector organisations, has lodged a joint submission to the VDO Review process for 2024/25.

A key element of the submission is that retailers' customer acquisition and retention costs should not be included in the 'cost stack' that is used to determine the VDO rates:

It is unfair for customers on the VDO to have the costs passed on to them of acquisition channels (such as third-party comparison websites or telemarketing), retention teams, and marketing costs targeted at driving customer acquisition or retention. Customers on the VDO are there because they are not on a market offer, not because they have come to the retailer due to any acquisition or retention activities.

The submission also argues that the allowable retailer margin to be calculated into the VDO should be reduced from the current supported rate of 5.3%, to reflect actual retailer margins, which have been declining since 2017, and are now as low as 3.9% in some jurisdications.

The AER is soliciting industry input for its DMO 6 deliberations for the upcoming 2024/25 financial year.

Although wholesale spot prices are now much lower than they were a year ago, energy retailers, through their lobby group the Australian Energy Council (AEC), are resisting any move to reduce retail prices via DMO.

The AEC's submission argues that the retail margins that are officially supported in the DMO calculations should increase to compensate them for having to pay households for rooftop solar power when the wholesale prices they receive when they resell that power are negative.

The AEC considers that in recent years the pendulum has swung well away from supporting reasonable and efficient margins and that the retail market is becoming increasingly unattractive as a site for equity investment ... it is important for the AER to ensure that DMO6 adequately supports reasonable and efficient margins and competition.

The AEC is concerned that there may be calls to reduce the retail allowance at this time. The AEC notes that the DMO regulations and objectives make the DMO different from other regulated prices. The DMOs twin objectives to incentivise retailer investment, innovation and competition in the market and the ability for customers to engage in the market.

Shell Energy, owner of Powershop, has argued that the Regulator must consider the costs to retailers of ongoing reforms such as smart meter rollout, Billing Transparency. Better Bills Guidelines, Consumer Data Right when setting the DMO price, and should not use the DMO price cap as a "mechanism to address cost-of-living pressures".

We consider it essential that the DMO reflect the realities of the energy market, and that it is not seen as a mechanism to address cost-of-living pressures.

It is a welcome opportunity to discuss retailer margins and true retailer costs including wholesale cost methodology, and we hope DMO 6 will deliver upon these items in a manner that aligns with the DMO's original objectives.

This is shorthand for the retail energy industry demanding increases to DMO rates in the upcoming 2024/25 period.

Bill Hero’s energy efficiency side-kick helps you minimise energy bills by minimising energy consumption

There’s always scope to increase your energy efficiency and decrease your bills.

Read our latest January Energy Coach for actionable tips and tricks to minimise your energy consumption through the heat of summer.

Here's a recent review from another happy Bill Hero subscriber.

Got opinions about estimated energy bills? Have your say in the comments, but please first read and understand our Community Guidelines.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.