Smart Meters are coming

The Australian Energy Market Commission (AEMC) is officially starting its Accelerating Smart Meter Deployment (ASMD) reforms. If you don’t already have a smart meter, you will by the end of 2030.

The ACCC has been running its Retail Energy Inquiry since 2018, but has only just discovered what Bill Hero has always known — energy retailers routinely charge their existing customers more than what they offer for new customers. You need to keep switching to stay on the best rates.

In August 2018, the then Treasurer, Scott Morrison, commissioned the ACCC to conduct inquiry into prices, profits and margins in relation to the supply of electricity in the National Electricity Market (NEM).

The terms of reference for the Inquiry include that the ACCC must report no less frequently than every six months, until August 2025, on matters including retail electricity prices faced by consumers, wholesale prices, profits made by generators and retailers, contract market liquidity, and the effects of regulatory changes.

Where appropriate, the inquiry will make recommendations to government(s) to take any proportional and targeted action considered necessary to remedy any failure by market participant(s) (or the market as a whole) to deliver competitive and efficient electricity prices for customers.

The December 2023 report's key findings include the impact of market volatility on retailer costs, consumer disengagement with complex pricing structures, and challenges small retailers face with access to hedging and risk management.

We were not at all surprised to read on page 9 of the report that retailers only compete to win new customers — consumer inertia allows them to gouge their existing customers.

Retailers compete at the point of acquisition, but are not incentivised to keep prices for existing customers competitive ... we found that consumers who do not regularly engage in the market experience higher prices.

The only answer to this billion-dollar problem is for energy consumers to pay close and constant attention to their bills and the market of offers available to them. Yawn! ... or to find a service that will do this for them 👀

Bill Hero subscribers will know that this is the bit that Bill Hero looks after for our subscribers.

Not a subscriber yet? What are you waiting for! Never overpay for energy again! Bill Hero automatically compares every bill to help keep you always on the best priced plan.

Wholesale spot prices and futures contract prices have moderated since the crazy price shock of 2022, but remained high through much of 2022–23.

This December 2023 report includes the first full year of data post the 2022 wholesale price shock, showing how these prices flowed through to retailers' costs and consumer bills.

Wholesale costs for retailers increased significantly, affecting residential and small business customers differently across regions. These rising wholesale costs have increased the average annual cost to supply electricity and contributed to higher retail prices, while also adding complexity to the retail market.

Retail margins in the NEM have now declined from making up 8.9% of an average retailer’s residential cost stack in 2016–17 to 2.3% in 2022–23. For small business customers, retail margins increased in 2022–23 but remained lower than in 2020–21.

Retailer margins varied across regions and customer groups. The report notes a decline in market concentration and an increase in active retailers, indicating positive competition signs, though these trends are beginning to plateau.

The retail energy market is competitive, but many consumers remain disengaged, resulting in them paying more than necessary for their energy.

Regulators have introduced the 'Default Offer', which is intended to set a reasonable base price in the market for disengaged consumers, while retailers make Market Offers, which typically are cheaper, and can be accessed by more engaged consumers.

For the first time, this ACCC report looks not only at the Market Offers currently available to new customers, but also at the plans that existing energy consumers are already on.

The analysis is sobering:

Even though about 90% of residential electricity consumers in the NEM are on Market Contracts, 47% of them are on plans with a calculated annual cost equal to or higher than the default offer

42% of concession-eligible customers are on plans with a calculated annual cost equal to or higher than the default offer

79% of residential customers could achieve a better offer if they switched to a competitively priced acquisition offer.

These results reveal what Bill Hero has long known — the existence of default offers does not constrain prices for existing customers. The default offer is designed to facilitate competition by setting a reference price that enables engaged customers to compare offers, but the evidence is clear that the majority of energy consumers are disengaged.

Bill Hero encounters actual bills from energy consumers on every billing cycle, and we could have told the ACCC long ago what they've now finally discovered for themselves: the core strategy of every energy retailer is 'tease and squeeze' — customers are acquired with deals or discounts, and retailers absolutely rely on consumer disengagement and inertia while they subsequently ratchet up the prices.

When consumers do engage with the market, it is not uncommon for their prices to increase not long after they sign up to a new plan ... retailers are able to ... increase prices at any time with at least 5 days’ notice to consumers.

Our analysis suggests that retailers recoup their costs over a customer’s lifetime, by setting attractively low acquisition offers and making subsequent unilateral price increases for their existing customer base over time. The accrual of these price increases over time explains why so many customers are on plans at or above the default offers ...

Electricity retailers are failing to reward millions of their loyal customers and are instead prioritising growing their businesses by offering discounts worth hundreds of dollars only for new customers, while charging more for existing customers.

Electricity retailers perform two main functions: they collect payments from consumers on behalf of the entire energy economy, and they manage and absorb wholesale spot price volatility and pricing risk for energy consumers. A key element of pricing risk management for energy retailers is access to hedging.

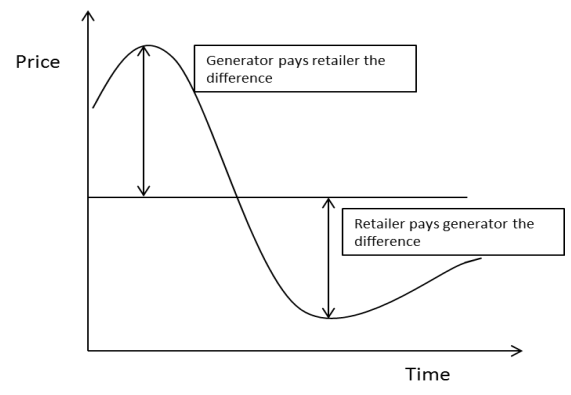

Hedges are financial contracts that retailers and generators can enter into, which mitigate exposure to wholesale spot price volatility, which can be extreme. The electricity spot price usually sits between $0 and $100 per MWh, but it changes every 5 minutes and can abruptly rise as high $16,600 or fall as low as -$1000 per MWh hour, depending on market conditions.

In many ways, hedging is just as important as the wholesale spot price in setting the eventual retail prices that will be faced by energy consumers. Retailers must hedge at least some of the energy their customers are forecast to consume, and many retailers hedge all of it. This means that the input cost for that energy to the retailer is their hedge, or future contract price, not the spot price, and this hedge price is what gets reflected in the retail price for consumers.

If the market for energy futures contracts is constrained, or illiquid, then pricing for consumers will be high, because pricing to the retailers for hedging will be high.

A range of products exists to allow retailers and generators to trade electricity in quantities that vary throughout the day and that are unpredictable. The basic products available are:

There is also a wide range of so-called 'exotic' contracts that are used by parties to manage risk, including: Weather contingent options that can only be used if a particular weather outcome occurs, such as above-average temperatures over a given period; 'Asian' options that can be called on if the average price of electricity is high over a predetermined period; Swaptions which are option contracts that give the holder the right to enter into a swap contract, if they choose to do so; Outage protection contracts that allow generators to protect themselves against the risk of being unable to sell electricity in the spot market; Load following contracts which are hedging products that follows the usage of the electricity consumer; Price Floors which give the holder the option to sell a given amount of electricity at an agreed price; and Collar contracts which combine cap and floor contracts to limit both upwards and downwards price movement exposure.

There are three ways that hedges are traded in the NEM:

One of the outcomes of the wholesale price shock 2022 was the withdrawal of Macquarie Bank and Bell Potter, the two main providers of clearing services for energy futures trades on the ASX.

Clearing requires that the provider assumes some financial risk for the transactions being supported, and amid the extreme price volatility of late 2022, first Macquarie and then Bell Potter decided that the risk was no longer manageable and they stopped offering their clearing services for energy trades.

This has particularly impacted the smaller retailers, 90% of whom cannot access hedging contracts on the ASX because they cannot find a clearing participant that is prepared to work with them. This could be because the clearing participants perceive small retailers to be riskier clients than larger participants.

As a result, smaller energy retailers must rely much more heavily on OTC hedging, which requires more bespoke and costly work, which puts them at a disadvantage, and further entrenches that natural advantage that the larger gentailers already enjoy.

Price volatility is only set to get higher as the transition to renewables advances, because renewables are more intermittent in nature. Increasing price volatility implies more complex risk management requirements, which further disadvantages small retailers and favours the vertically integrated gentailers, which have both their own natural internal hedge plus greater financial weight which will provide easier access to exchange-traded energy contracts.

There is therefore a reasonable prospect that retailers will find it materially harder to source affordable, financially-firm contracts. If retailers are unable to easily source these financially firm contracts, they will be exposed to material financial risk, especially if they are not vertically integrated.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.