Smart Meters are coming

The Australian Energy Market Commission (AEMC) is officially starting its Accelerating Smart Meter Deployment (ASMD) reforms. If you don’t already have a smart meter, you will by the end of 2030.

Things have 'stabilised' in the retail energy market, which is good, except for the unfortunate reality that energy prices have stabilised at a level far higher than they were in May 2022.

Welcome to another issue of Savings as a Service, the Bill Hero newsletter. With this issue #10, we've reached double figures! And we're celebrating with some great new features, coming soon for the Bill Hero service.

We can't wait to make these new capabilities available to all Bill Hero subscribers, but before we can, we need some help with refining and testing, so we're putting out the call for new members of our new Beta Program.

Also in this issue, we've got more on the slow motion train crash that is retail energy pricing in Australia. The first price shock has rolled through the market, pushing up everyone's prices, but as we explore in our feature story, unfortunately there's still more to come.

No matter what happens in the energy market, Bill Hero will help keep you always on the best priced plans.

If you're not already a subscriber, then its time to join - for a modest fee, we'll help keep you always on the best priced plans, and we even offer a money-back guarantee that we'll save you more than the cost of an annual subscription over the first year, so you just can't lose.

Not a subscriber yet? What are you waiting for! Never overpay for energy again! Bill Hero automatically compares every bill to help keep you always on the best priced plan.

We're all resigned to the fact that higher energy bills are here to stay for the foreseeable future, due to factors we've previously discussed in this newsletter: high reliance on fossil fuels in the Australia generation mix, heightened global demand driving increased prices for the coal and gas input fuels, driven by conflict in Ukraine and the resultant drive across Europe and the world to stop buying Russian gas.

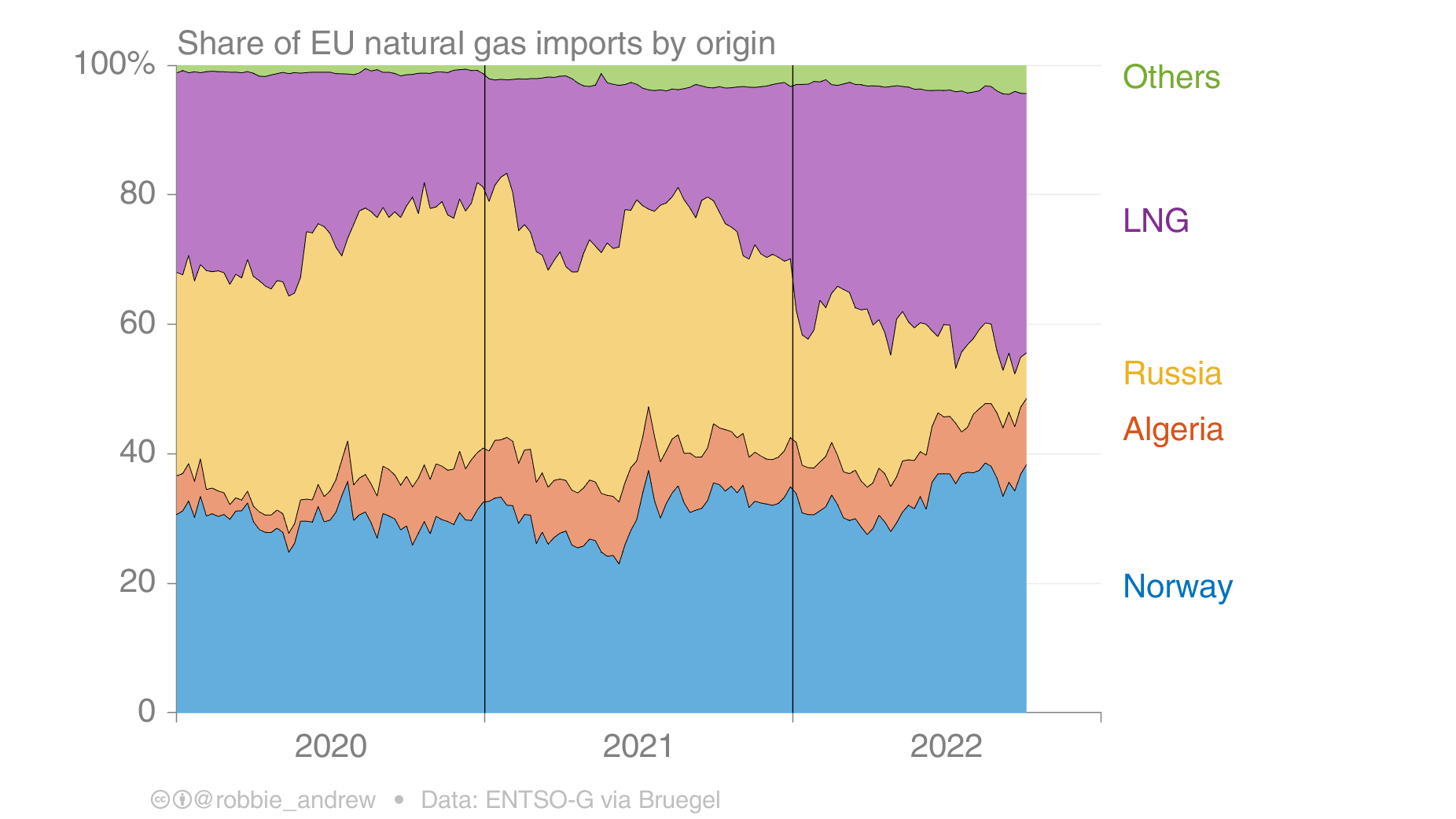

Here's a telling chart illustrating some major changes to European Union gas imports:

Russian share of EU gas imports has declined from a peak of about 40% in 2020, down to only about 5% now.

The main replacement of Russian gas supply to the EU is LNG (liquid natural gas) for which Australia is the world's biggest exporter. This is one of the key drivers of the increased price for Australian gas exports.

Unfortunately for our energy bills, the Australian east coast gas markets have no domestic reservation policy, so our domestic consumption is directly exposed to those same export prices, and the high prices for gas as an input fuel for electricity generation is driving up prices for our wholesale and retail electricity.

In Australia, we've already seen dramatic retail price increases, and unfortunately things only look to be getting worse.

"Next year, using the current market prices, tariffs are going up a minimum 35 per cent"

“Next year, using the current market prices, tariffs are going up a minimum 35 per cent,” Alinta Energy CEO Jeff Dimery told the Energy and Climate Summit in Sydney.

Here's why. Although the wholesale energy market is a dynamically priced auction, with constant price fluctuation, there is a futures market for electricity which is used by market participants to bring some surety to the prices they'll be exposed to in future, through hedging, and its these futures prices that largely dictate the pricing trends at the retail level.

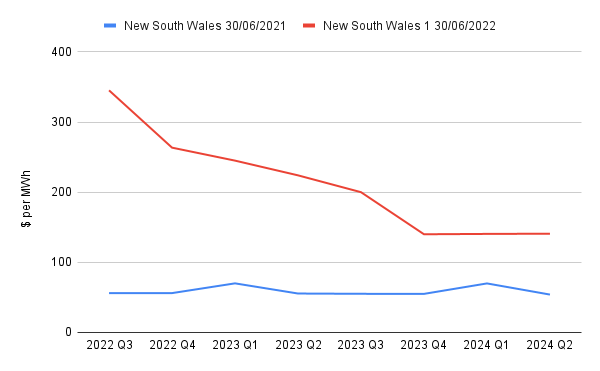

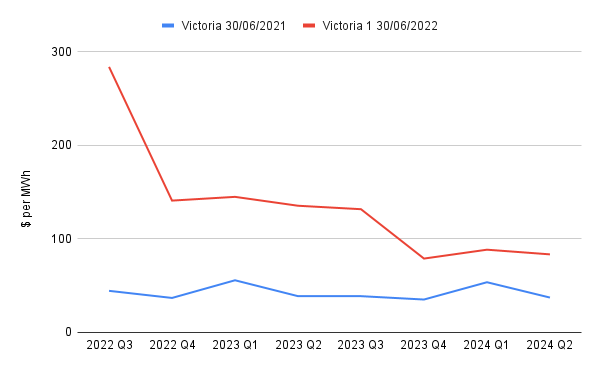

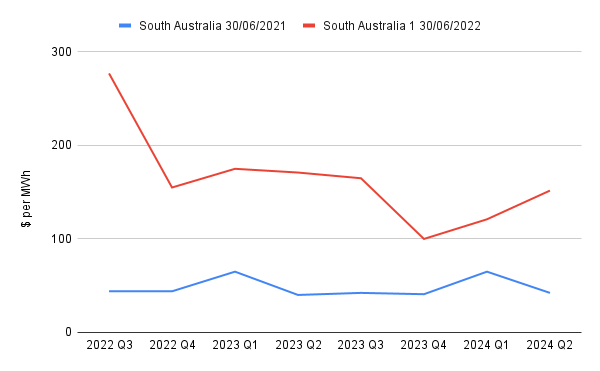

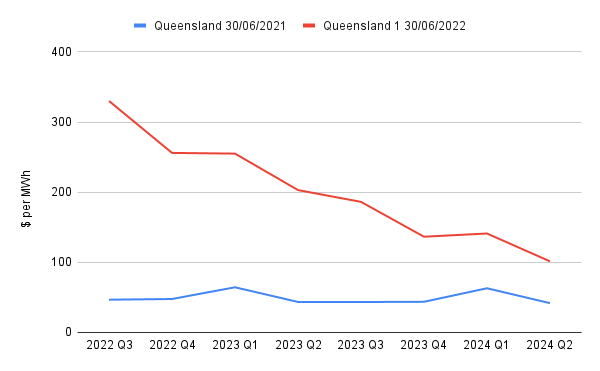

The range of electricity futures prices in all NEM states, over the period of Q3 2022 through to Q2 2024 (shown as red lines), are markedly higher now than they were a year ago (shown as blue lines).

The forward pricing for energy declines over time, reflecting the expectation that higher pricing will naturally attract investment in generation, which increases supply of energy over time, and will drive down prices.

The market has priced-in the expectation that wholesale electricity rates in Q2 2024 will be at least double what was expected back at end of June 2021.

On these numbers, the market has already priced-in the expectation that wholesale electricity rates in Q2 2024 will be at least double what was expected back at end of June 2021.

You'd be forgiven for assuming that the energy futures prices are straight forward contracts where buyers can manage their price hedging by agreeing to pay a certain price per MWh, and sellers will then deliver at that price.

It's actually a bit more complicated than that. Energy generators bid their production into the market dynamically, at whatever price can be borne by the wholesale market at the time of dispatch.

Energy retailers, who are the primary buyers of wholesale electricity, need to manage their price hedging by accessing brokerage or 'clearing' services from financial providers through which they settle their energy purchases.

A clearing house acts as intermediary, and simultaneously takes on the proxy roles of buyer and seller in order to reconcile orders between transacting parties. There is risk in clearing these transactions, because the sellers may not deliver and the buyers may not pay. So the clearing house requires buyers and sellers to provide collateral, known as 'the margin', as security.

Clearing houses set the required level of margin according to their appetite for, and assessment of, the risk in clearing these transactions. They need to maintain a margin sufficient to accommodate the short term price movements they may be exposed to while settling energy trades. In times of increasing volatility, those price movements and the risks become increasingly significant.

Back to Alinta CEO Jeff Dimery, who said on 10 October that the cash collateral requirement for Alinta has already increased to $700 million, up from $200 million and “our view is it’s heading to a billion and beyond”.

“Every time we write a futures contract off our power station, I have to put more collateral into the market,” he said. "So I’m looking forward to a margin call from Macquarie Bank later today on our margin position, which will go up.”

Even this somewhat dour prediction now appears wildly optimistic. Instead of merely increasing the margin requirement, Macquarie has stopped offering clearing house services altogether, a decision closely followed by Bell Potter, another major energy clearing house provider.

Macquarie typically worked with larger electricity traders, including Alinta, while Bell Potter serviced many of the smaller operations without the access to credit enjoyed by bigger players.

This retreat of the clearinghouse providers will significantly restrict the ability for all energy retailers, especially the smaller ones, to access price hedging, which further increases the vulnerability of the industry to the global energy crunch.

Adding to the misery for the Australia retail energy sector is the still unpaid bill for $114 million in compensation payments to generators who were ordered by AEMO to continue producing energy during the market suspension in June this year.

These costs will be recovered from energy retailers in proportion to their energy purchases during the June event period, and retailers will recover those costs from consumers energy bills.

As prices steadily climb higher its more important that ever to get on top of your energy consumption.

One of the best ways to achieve this is by generating your own electricity with a solar installation. If you're not sure where to start, our partners at SolarQuotes have you covered.

Bill Hero has partnered with SolarQuotes, the leading Solar quote provider in Australia, to help you get up to 3 no obligation solar quotes from fully qualified installers, absolutely for free.

Check out Energy Coach for actionable Spring tips on minimising your usage

The continuing upheaval in the retail energy market only makes it more important for Bill Hero to continue delivering on our mission to help Australian energy consumers always stay on the best priced plans.

Since our last newsletter was published we've delivered another important part of that capability, with the release of the Bill Hero subscriber portal.

The subscriber portal adds an important new set of self-serve capabilities to make it easier for subscribers to access and change their account settings, including subscription details, changing your Bothered Threshold, finding your forwarding address.

Here's all the articles published in the Savings as a Service blog since our last newsletter

We’ve taken the first steps toward fostering a Bill Hero community by enabling Comments for the Savings as a Service blog that this newsletter forms part of.

Signed-in users can comment on any post, including this newsletter post! Just scroll down to the bottom of the page, and comment away. But before you do, please check our Community Guidelines:

We can’t wait to see how this develops over time, and we hope we can foster a useful and productive shared community of engaged energy consumers.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.