All about GreenPower

Bill Hero lets you see and compare exactly how much it will cost you to step up to a GreenPower renewable energy plan

GreenPower is a government-accredited scheme that allows energy consumers to “recognise and purchase renewable electricity that meets stringent environmental standards.” Many Green consumers support renewable generation by choosing GreenPower and voluntarily paying more for their power.

Not all retailers offer GreenPower. Those that do are listed in the GreenPower website.

If you're unsure about how much GreenPower might cost you, or if you're considering if you would apply GreenPower uplift to some, or all, of your kWh consumption, you can use Bill Hero to see exactly how much it will cost you to step up to the various levels of GreenPower energy plans available from all the retailers.

This is important because there is a very significant variation in the price uplift charged by the retailers in their GreenPower plans – the most expensive GreenPower plan in the market is 400% more expensive than the cheapest one.

Also, as we'll show in this article, contrary to common assumptions, the money you voluntarily spend on GreenPower does not directly translate to money invested in renewable energy. The GreenPower scheme brings a massive arbitrage and financial gaming opportunity for retailers, which means that they have plenty of room to maximise their own benefit from your voluntary GreenPower contributions.

In this article, we'll explain how GreenPower actually works, how the retailers can game it, and what you can do to support renewable generation in the most cost-effective way.

How GreenPower works

When you buy GreenPower, you create an obligation for your retailer to purchase and surrender GreenPower certificates, known as 'Large Scale Generation Certificates', or LGCs, equivalent to your energy consumption.

LGCs are created by accredited renewable energy generators, and each certificate represents 1 MWh of electricity. Retailers are obliged to purchase and surrender LGCs equivalent to the aggregate GreenPower consumption of their customers each year.

The GreenPower certificate scheme creates a revenue source to support the development and operation of renewable energy generators. Only generators built after 1997 are accredited under this scheme. Older renewable generation assets including hydro do not qualify as GreenPower generators.

Because renewable energy generators create the LGCs, revenue will flow to them through this scheme, so your purchase of GreenPower helps support the development and operation of renewable energy generation assets.

What about older hydro renewables?

Hydro renewable generation assets owned by Snowy Hydro and Tasmania Hydro, do not qualify for the GreenPower scheme because they were commissioned before the scheme's 1997 start date.

Snowy Hydro owns the retailers Red Energy and Lumo Energy, and Tasmania Hydro owns Momentum Energy. Because these retailers are part of vertically integrated renewable generation businesses, they can legitimately make claims to their customers such as this 'renewable matching promise' from Red Energy:

For every unit of electricity you buy from Red Energy, Snowy Hydro Limited will match it by generating one unit of electricity from a renewable source.

These renewable matching promises are private schemes that deliver a near-equivalent outcome to GreenPower, in that they also result in the delivery of renewable energy to the grid equivalent to your consumption.

Typically these kinds of hydro-backed renewable generation promises are promoted to retail energy consumers for free, while those same retailers also offer a paid GreenPower option.

The difference is that the GreenPower scheme is specifically designed to support and encourage the creation of new renewable generation assets.

How retailers game GreenPower

Many GreenPower energy consumers naively assume that the price uplift they pay will directly contribute to new renewable generation. This is not the case. Retailers are obliged to buy and surrender LGCs to the equivalent level of electricity consumption, not to the equivalent level of money spent.

LGCs are traded in the same way as other commodities or financial instruments, so there is a spot price and a futures market for LGCs. Retailers participate in this market and use hedging and trading strategies to maximise the benefit from their participation.

Buy low, sell high

The first and most obvious LGC strategy employed by retailers is to buy low and sell high. Retailers are free to set their own rates for the GreenPower uplift they charge to their customers, so there's a direct arbitrage opportunity between the price they charge you for GreenPower and the price they must pay for the equivalent LGCs.

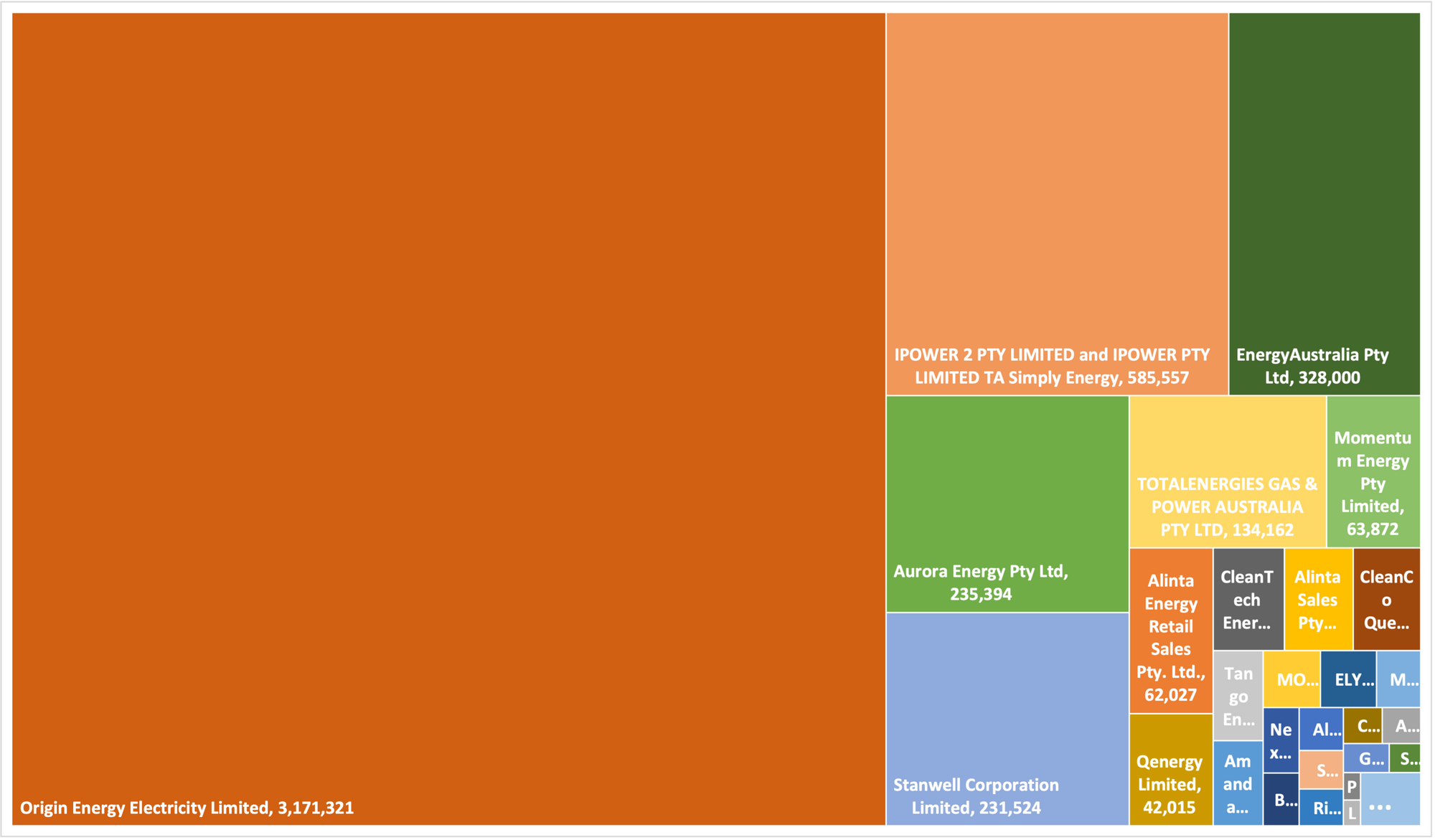

We've done the research and have found significant price variation among retailers for their GreenPower offers – at the time of this writing, the highest GreenPower per-kWh price on offer is over 400% more expensive than the cheapest.

LGC Shortfall strategy

A less obvious strategy is the timing of the certificate surrender. The rules for the GreenPower scheme include penalties for failing to surrender the required number of certificates on time, but the rules also allow for those fines to be refunded in future at the time of eventual surrender.

The LGC market operates like any other, with prices going up when demand outstrips supply, and going down when supply outstrips demand.

So if your retailer believes the price for LGCs will decline, they might postpone their obligation to purchase and surrender LGCs that you've already paid them for, in the expectation that they can fulfil the obligation in future at a lower price. This reduces current demand for LGCs, thereby driving down the market price for LGCs which reduces all the GreenPower revenue that flows to accredited renewable generators, not just from your retailer.

The LGC Shortfall strategy reduces demand and depresses the price for LGCs, which reduces the GreenPower revenue that ultimately flows to renewable generators

The LGC shortfall strategy, which some retailers have adopted very aggressively, arguably supports market outcomes in opposition to the intent of GreenPower consumers, whose money helps fuel the entire process.

The Clean Energy Regulator maintains a public Shortfall Register, which presents the certificate shortfall and shortfall charges for each liable entity by assessment year.

How to support renewable generation the smart way

Both the 'buy low, sell high' strategy and the 'LGC shortfall' strategy play to the advantage of the retailer, at your expense.

Many retailers seem to think that, by definition, GreenPower consumers are not price-sensitive, since they have volunteered to pay more for their power than they need to.

Some retailers take this as an invitation to ramp up the prices they charge for the GreenPower they sell. This is pure arbitrage, any overspending only benefits the retailer.

Given the indirect nature of the money transfer and the propensity for retailers to overcharge and game the GreenPower system, it makes sense for green-conscious energy consumers to find the most cost-effective GreenPower option.

Bill Hero's GreenPower pricing and filters allow you to support renewable generation the smart way, maximising the impact you can make while minimising both the cost to you and the opportunity for your retailer to game and skim this market.