Energy Coach - July

It's here - we're in the middle of winter, and most of us are feeling the chill, as well as the pain of high energy bills. Here's our roundup of what you can do to shrink your bills while keeping your home's comfort levels high.

Wholesale energy prices are through the roof and impacting everyone's bills. This article explains the market operations and pricing mechanisms that set wholesale spot prices for the Australian National Electricity Market (NEM).

We keep hearing that wholesale prices are pushing up the prices we're charged in our retail bills. That's an easy enough concept to understand, but let's look at how those wholesale prices actually get set.

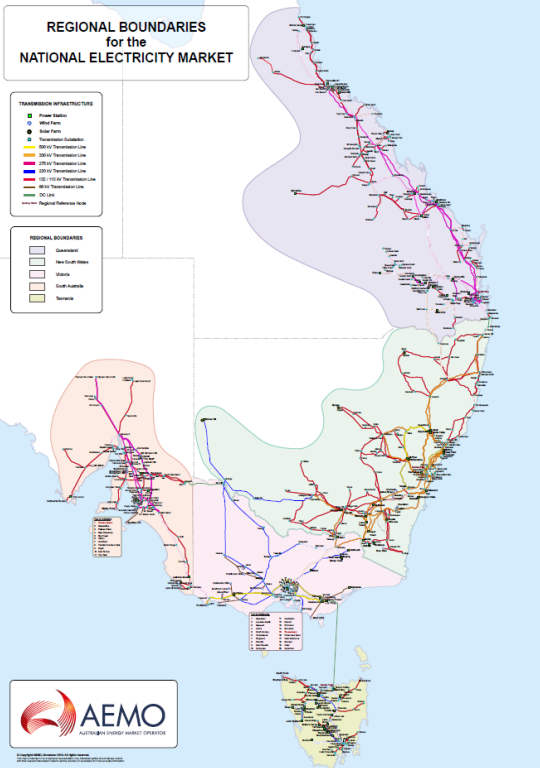

The National Electricity Market (NEM) is the power system and associated markets that connect each NEM region - QLD, NSW, ACT, VIC, SA and TAS.

WA and NT run their own independent 'island' electricity distribution networks and are not part of the NEM.

Each NEM region has its own spot price for electricity, except for ACT which is considered part of NSW.

The NEM is an energy-only market. This means that the energy generators – coal-fired power stations, wind farms, gas power stations, etc – only ever get paid by generating and dispatching electricity, so the owners of those generators bear all the costs and financial risks in building and maintaining those generators in the expectation that they'll be able to sell (dispatch) electricity into the NEM.

This structure differs from a capacity market, which exists in Western Australia and in some overseas markets, where generators are paid not only for the energy they generate and dispatch but also for maintaining a guaranteed level of stand-by generation capacity that can be accessed if needed.

Electricity is an unusual commodity because it cannot be stored, at least not at a meaningful scale proportional to overall demand. This means that electricity generation must always be matched with electricity demand in real time.

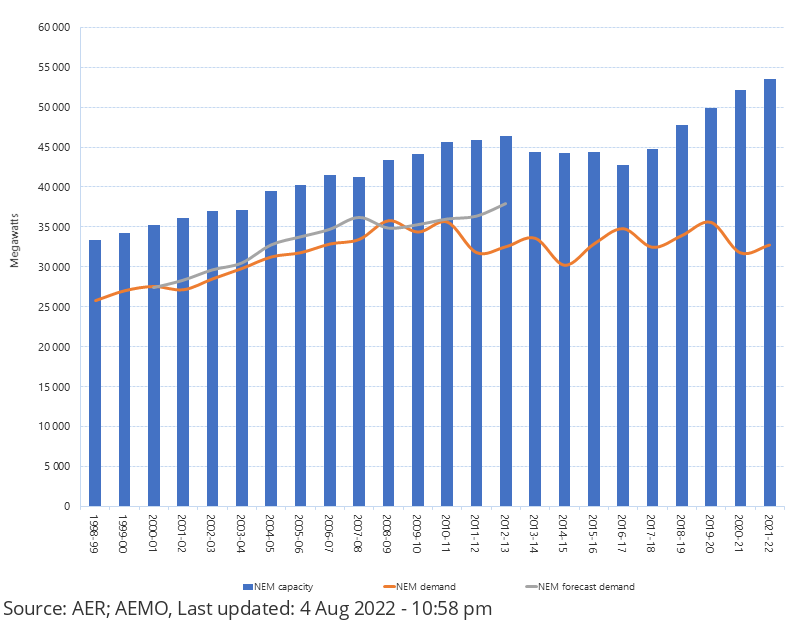

There is about 65,000 MW of total aggregate generation capacity in the NEM. Consumer demand for electricity varies throughout each day and fluctuates seasonally, so only a subset of this capacity is required at any given time.

However, the aggregate generation capacity must always be larger than the actual demand to accommodate any spikes in demand and to support a buffer for downtime and outages of individual generators. Having too small a margin between anticipated peak demand and maximum aggregate generation capacity increases the risk of power outages.

The Australian Energy Market Operator (AEMO) manages the operations of the NEM to deliver the most cost-efficient combination of generation and storage required to meet consumer demand for electricity at any given time. AEMO's core activities include:

The dispatch process is the most complicated and interesting part of the NEM operations. AEMO manages this through an auction where generators bid in five-minute windows for the right to supply energy to the NEM at a specified price per mWh. AEMO will choose the cheapest combination of generators required to satisfy the real-time demand across the NEM.

Each individual electricity generator has unique characteristics for the cost and availability of the power it produces. Considering these factors, each generator places bids to the AEMO daily, offering to supply the market with specified amounts of electricity for set time periods at specified prices.

Some generators may offer electricity at negative prices because it costs them more to ramp down and turn off their generator than it does to accept negative prices for continuing production.

Prices can range between the market floor price, currently -$1000/MWh, to the market cap price, currently $15,500/MWh.

The prices bid by each generator will differ based on:

The Market operator collates the prices offered by each generator and 'dispatches' the lowest-cost combination of generator volume and price bids required to meet the forecast demand for each 5-minute dispatch period.

This approach to choosing the lowest-cost combination of generation sources is known as merit order pricing.

Merit order is used to determine the order in which energy sources are dispatched to the grid to meet demand, with the lowest-cost sources dispatched first.

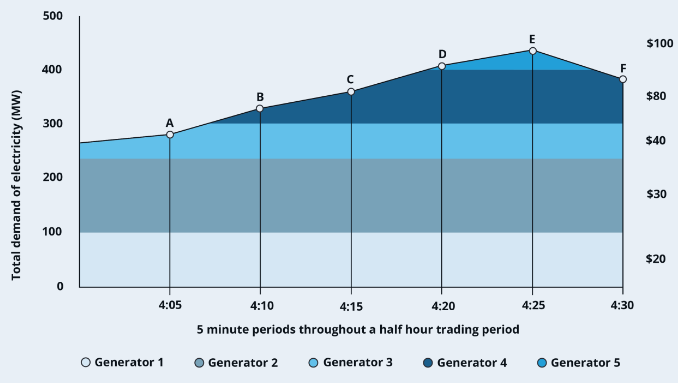

The NEM operates with a 5-minute dispatch price window, and the 5-minute dispatch prices are averaged into 30-minute blocks to determine the wholesale market 'spot' price.

Every generator that is dispatched in that 30-minute window will be paid the same spot price per MWh for the energy they dispatch, regardless of the price they bid.

In this simplified example provided by AEMC, we can see how electricity is dispatched and how prices change over a 30-minute settlement period.

Over this 30-minute settlement period, the dispatch price has varied between $40 and 100 per MWh over 6 dispatch periods. These dispatch prices are then averaged to determine the spot price for the settlement period.

The spot price for this 30-minute period is ($40 +$80 + $80 +$100 + $100 + $80)/6 = $80 per MWh.

The spot price sets what will actually be paid to all the generators dispatched during this period, regardless of what they bid.

Therefore, the spot price also sets what the energy retailers must pay the generators for the energy that their customers consumed during this settlement period.

Spot prices can be very volatile, with extreme fluctuation in pricing, which means that retailers must manage the risk of collecting payments. No matter how the spot price varies, retailers are absolutely on the hook to pay the relevant spot price to the generators for the consumption of their customers - in the second half of 2022 the Australian wholesale energy market saw unprecedented wholesale price shocks, which drove ten retailers into receivership.

Merit order ensures that the grid is supplied with the lowest-cost energy sources available. This keeps energy prices as low as possible for consumers and encourages the use of renewable energy sources, which are typically cheaper than fossil fuels.

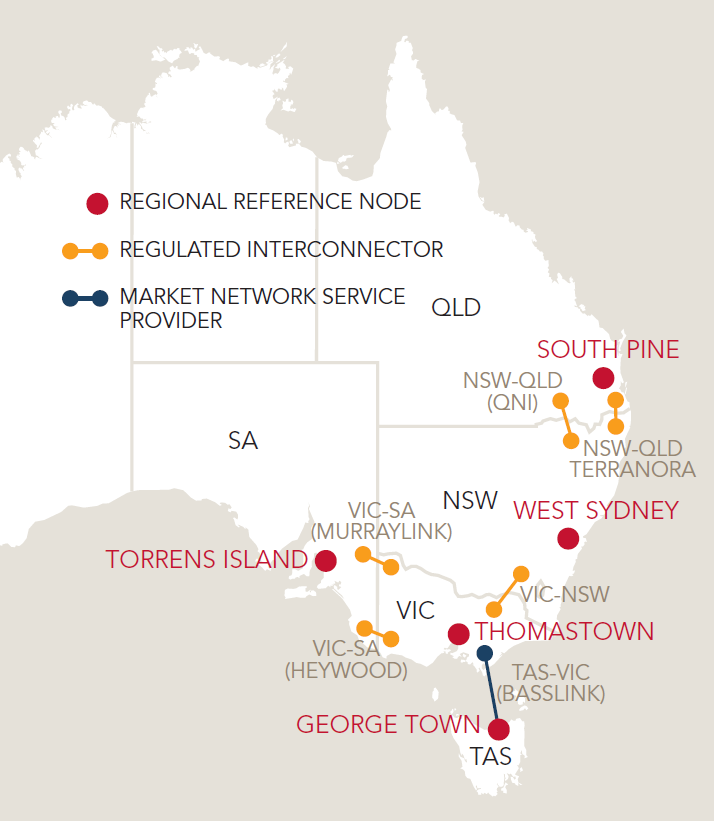

The NEM operates in five regions - South Australia, Melbourne, Tasmania, New South Wales, and Queensland - with interconnectors (transmission links) that join the regions and regional reference nodes (RRNs) at the largest load centre of each region.

Spot prices are calculated at each regional reference node. The spot price at a regional reference node can be set by generation within that region or in another region.

Electricity moves through interconnectors that deliver energy from lower-price regions to higher-price regions. This can equalise prices between regions if the interconnect capacity is sufficient. Spot prices will separate if the interconnect reaches capacity before the price equalises.

Interconnectors are a partial substitute for local generation in a region to the extent they enable the import of electricity, which can mitigate the need for local building of generation capacity in a region.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.