Smart Meters are coming

The Australian Energy Market Commission (AEMC) is officially starting its Accelerating Smart Meter Deployment (ASMD) reforms. If you don’t already have a smart meter, you will by the end of 2030.

The emerging east coast gas crisis looks set to only get worse.

One of the primary drivers of electricity price increase has been the abrupt increase in the price for gas. Although gas is used primarily as a 'peaking' generation resource, the presence of gas in the generation fleet often sets the overall dispatch price, which becomes the effective price paid for all energy generation for that period.

We're now seeing a scenario emerge where despite being the largest exporter of gas in the world, there's a threat of a 'gas shortage' driving up prices. This is the result of increasing global demand, coupled with the lack of a domestic reserve policy that would retain some of this locally produced gas for local consumption.

It's easy to think that our emerging gas crisis is a recent phenomenon, created out of the global energy turmoil caused by Russia's invasion of Ukraine and the related threats to European and global gas supply from Russia.

But it's been brewing for a long time, and is coming to a head now due to Australia's continuing reliance on gas and fossil fuel generation, despite having the best renewable resources in the world, and due to allowing a small number of gas exporters to gain a stranglehold on the East Coast gas market, where they can now effectively dictate terms and prices.

In 2017, the Turnbull Liberal government implemented the Australian Domestic Gas Security Mechanism which empowers Australia government to enforce curtailment of exports when there is risk of domestic shortages. This was in response to a 2017 gas domestic shortfall scare, occurring at the same time as Australia took the lead as the largest global exporter. The government also initiated a wide-ranging 3-year ACCC inquiry into the supply of and demand for gas in Australia.

In July 2019, then Treasurer Josh Frydenberg extended the ACCC inquiry until December 2025.

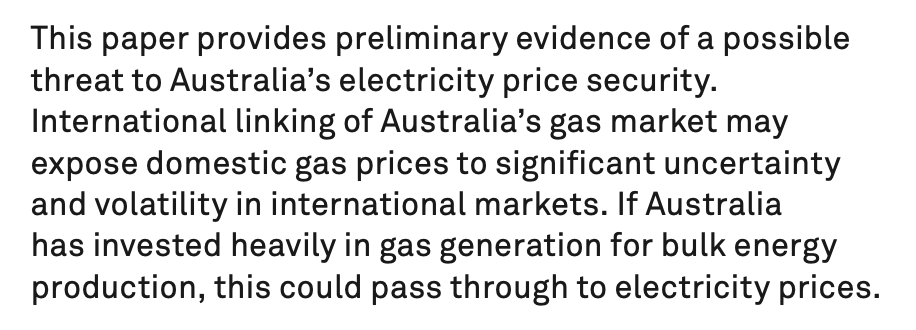

And well before then, back in 2012, an AECOM research paper specifically called out the risk to domestic energy pricing in linking gas to the global export markets, and recommended investment in a broad generation portfolio, including renewables, to counter this risk:

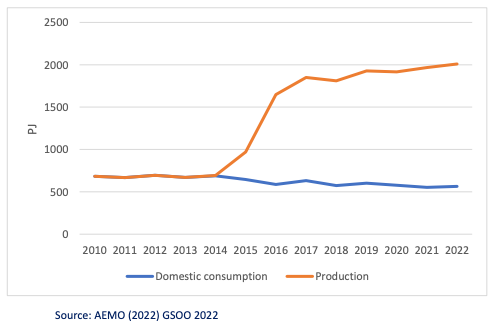

The first shipload of LNG left the Gladstone export terminal in October 2015, linking domestic gas production with global markets for the first time.

Since then, we've seen steady development of gas export, with very little counterbalance in diversified in energy generation.

There are now three gas export terminals in Gladsone, QLD. Local energy giants, Santos and Origin, hold major interests in two of them. Global energy giant Shell controls the third. The gas itself is produced by Origin's Australia Pacific LNG, Shell's Queensland Curtis LNG, Santos' Gladstone LNG AGL, and Woodside.

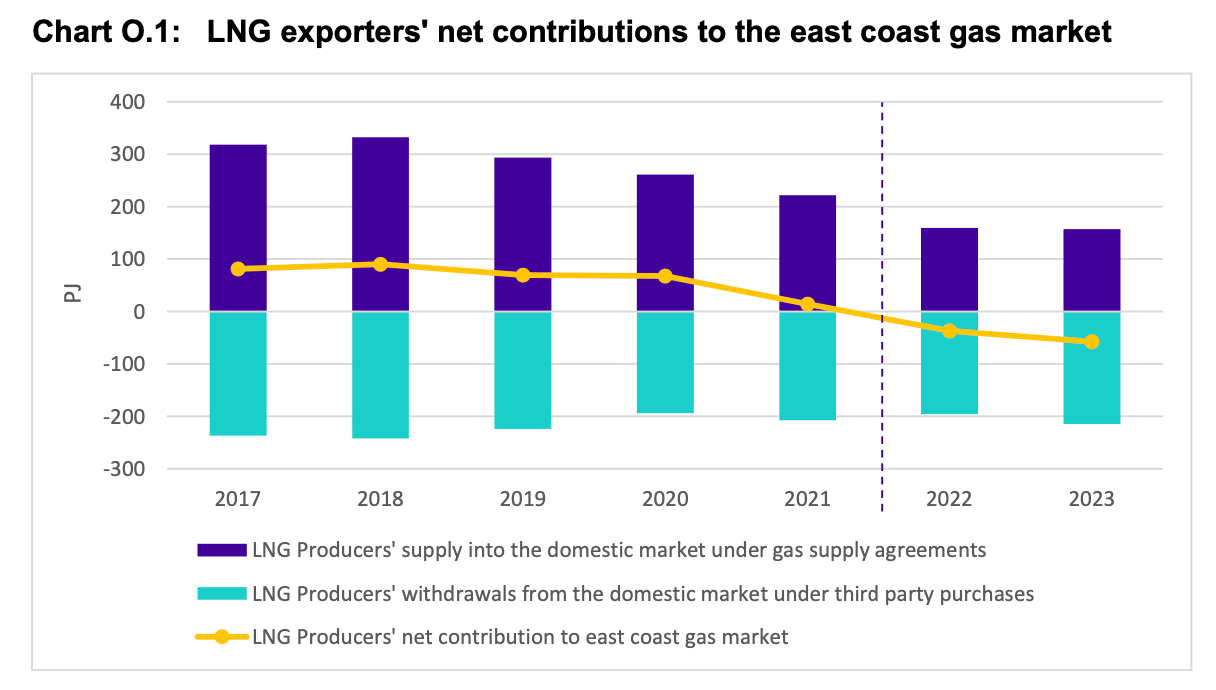

In March this year, just before the current pricing crisis really hit, ACCC commissioner Anna Brakey made a speech that clearly foreshadowed the current reality

"LNG producers have been supplying less and less gas into the domestic market for the last five years, and the downward trend is continuing ... In 2022, the expected domestic supply from the LNG producers is about 50 per cent less than the actual supply in 2017 and 2018," she said.

And she directly pointed the finger at the gas producers for creating the domestic shortfall.

"It's this rapid and significant reduction in domestic supply from the LNG producers that's contributed to the tight and uncertain conditions in our domestic market ... And let's be clear – this is at odds with what government was told before the LNG projects were developed. Gas companies assured governments that there was sufficient supply and that domestic gas prices wouldn't go up."

The ACCC has just published its 13th update in its ongoing inquiry into the supply and demand for gas in Australia

This most recent chapter in the ongoing inquiry has been keenly awaited by industry commentators, since we're now experiencing the full brunt of integration with the global gas market.

Domestic power bills have already doubled because the price of gas has shot up tenfold from $5/GJ to $55/GJ.

And it's only going to get worse. According to the report, domestic and LNG export demand in the East Coast of 2,037 PJ is projected to exceed the available supply of 1,981 PJ in 2023, resulting in a supply shortfall of 56 PJ.

This is an extraordinary situation for the world's biggest gas exporter to find itself in and presents real risk to Australia's energy security.

The obvious expected outcome is continuing upward pressure on prices, and the need for demand to be 'curtailed' with the gas equivalent of a blackout. This might mean forced shut down for large gas consuming industrial operations, or no hot showers for gas consumers. Or both.

These effects are most likely to impact gas users in the southern states, where gas is more prevalent, but given the interconnected nature of the market, could also affect users in Queensland.

To address the projected shortfall in 2023, significant additional volumes of gas will need to be:

All, these possible means of addressing the shortfalls ultimately depend on the decisions of the LNG exporters, and only the last measure will have a significant impact.

So the pressure is now on politically to apply pressure to the gas exporters to reserve gas supplies for domestic consumption, rather than export it and capitalise on the record high global prices.

So far this has included review of the Heads of Agreement, renegotiated by the Morrison government in 2021, under which gas exporters currently operate, and an extension of the Australian Domestic Gas Security Mechanism which includes that if there is a supply shortfall in the domestic market, the Minister for Resources may require that LNG projects limit their exports or find new gas sources.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.